Record Growth for Monaco Real Estate Market

Monaco is the richest and most glamourous country in the world, known for its high average income and individual wealth and for being the location of one of the most dramatic Formula 1 Grand Prix circuits in the sport.

Homes in the tiny Principality have long been beyond the reach of buyers without bottomless pockets and yet its property market is accelerating at a greater pace than Nico Rosberg's F1 Mercedes when he won Monaco's 2015 Grand Prix in May.

Monaco saw record property sales in 2014 and looks set to do the same this year, according to global real estate advisor Savills. The Principality's status as a tax haven makes it an attractive place to establish residence for wealthy people from all over the world. A significant number of residents are from a variety of nationalities and many are celebrities, making Monaco synonymous with wealth, power, fame and prestige the world over.

Material symbols of wealth such as luxury goods, expensive cars and exclusive shops are visible everywhere, while Monaco's coastal position makes it a popular port for luxury yachts. Long-established as a safe haven for European and international investors, Monaco nonetheless took a hit during the global recession with cumulative value of resales plummeting 53.9% down to €495.8m, according to a study by Ismee Monaco statistics.

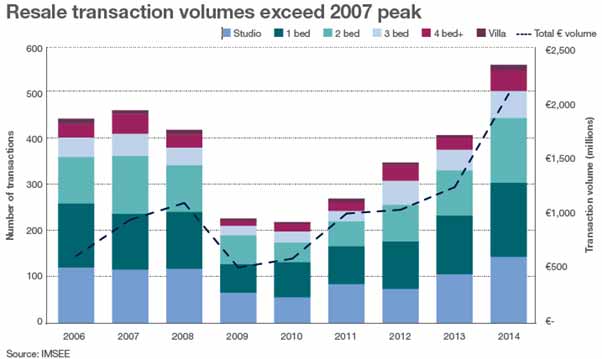

Monaco's real estate market stopped and started through to 2010 and began to recover the following year when sales rose to €980.5m. Since then, transactions volumes have increased by a massive 159%, with most growth being recorded in 2014, when sales soared to 555, 21% higher than at market peak in 2007 and aggregate values broke the €2bn mark for the first time ever.

With property prices in the region of €60,000/m2, Monaco remains one of the world's most expensive real estate markets, yet in dollar terms it has slipped to second place behind Hong Kong as a result of euro weakness. The Principality's property market is driven by demand for small homes in its resale sector, with properties having up to three rooms accounting for 80% of transactions and 50% of the total value in 2014.

The new development market is tiny and exclusive and since the global economic downturn, developers in Monaco have shifted their focus to the global ultra-prime segment, developing larger units at higher price points. This has pushed new build sales volumes to €345m, two-and-a-half times the volume recorded in 2013 and 13 times that of 2008.

Paul Tostevin, associate director of Savills World Research said: "The unique offering of Monaco's global appeal and it's extremely limited land supply will all combine to keep its real estate prices with few or no mechanisms for them to fall. Prices are at, or near, a high plateau and will be for some time to come".

There is every expectation that prices in Monaco will remain solid in 2015 because supply is extremely short – the pipeline of new development currently being built in the Principality will hit the market in a few years, while demand is very strong. Savills found that for the global super-rich, Monaco is part of a network of city property holdings that also includes London, New York and Moscow.