Guide to Property in Spain

In the past four years alone, the British have increased their spending on overseas properties by 45%. The Spanish Ministry of Tourism predicts that more than one million foreigners will set up home on the Spanish coast in the next six years, and this figure is expected to treble by 2025.

Use the search facility on the left menu to search for suitable Spanish property or browse the other informational pages and articles we offer to help you find your dream rental property in Spain.

Propertyshowrooms.com and Property In Spain

For many years property in Spain has been in great demand. There are many reasons for this including; the warm climate and stunning beaches, the Spanish peoples' hospitality and way of life, the already existing infrastructure and Spain's close proximity to home for other Europeans.

The price of property in Spain has been competitive compared to most other locations and potential for growth is huge. Similar laws and finance options to “back home” make buyers feel more comfortable than purchasing in many other worldwide destinations.

In recent months many stories have been told about the negative future of the property market in Spain. However, government facts and figures and some recent news articles indicate this is simply not the case. The price of property in Spain is still rising, demand is still high for Spanish property and it has remained a firm favourite with property investors, especially for the Buy-to-Let market.

The internet revolution is now allowing holiday-makers to purchase cheap flights and rent apartments on-line, cutting out the travel agents and making rental property in Spain a highly sought after product to feed the sun and golf-loving tourist industry. Without any doubt, property in Spain is still thriving!

Can Foreign Nationals Own Property in Spain?

Foreigners can freely purchase property in Spain. In fact for decades, worldwide investors have purchased heavily in Spanish real estate.

Since the restoration of the monarchy in Spain, the gates have been opened to heavy foreign investment in property which, during the days of General Franco, was greatly restricted.

Why Should I Choose Spain?

The Spanish property market over the last 20 years suggests it is one of the best investment opportunities in the current economic climate. Spain represents a safe and stable investment and has seen spectacular property prices rises in recent years.

Excellent rental income can be obtained from your property provided it is located in a good tourist location close to all amenities. Southern Spain boasts around 320 days of sunshine a year, attracting year-round tourism, whether for the beautiful sandy beaches in the summer or the top-class golf courses during the cooler months.

What is the Economic and Political Situation?

Despite the decline of many of its industries during the world recession, Spain achieved the highest average growth rate in the European Community during the 1980s. Its economy boomed from 1986 to 1990, averaging an annual growth rate of 5%.

The centre-right government of former President Aznar successfully gained admission to the first group of countries to launch the Euro on 1 January 1999.

Spain is now fully integrated into European institutions and is also a NATO member. After the terrorist attacks on the US on September 11, 2001, President Aznar became a key ally in the fight against terrorism. Spain backed the military action against the Taliban in Afghanistan and has taken a leadership role within the European Union in encouraging increased international cooperation on terrorism.

The cost of living in Spain is generally around 20-30% less than in the UK.

How do we Travel to Spain?

As the property investment market continues to grow in Spain, airlines constantly strive to keep up with the huge demand for more flights to all main tourist destinations in Spain. Numerous low cost airlines offer low fares, internet bookings and increased services to cater for the booming tourist trade in Spain. As ease of access increases, Spanish property remains ever popular with high returns gained from a stable tourist economy.

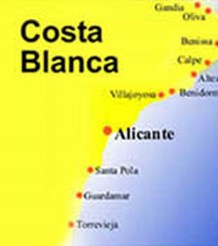

The most popular destinations for travel in Spain are on the Mediterranean coast, from Barcelona, Valencia, to Almeria, Granada and Málaga, all of which are served by major international airports.

Rail and road links are also considered to be excellent and fall in line with normal European standards.

What is the Direct Flying Time from UK to Spain?

Flight times are a mere 2 ½ hours.

Is a Visa Required to Enter Spain?

A Visa is required by all except the following country citizens for stays of up to 90 days:

- Nationals of EU countries, Australia, Canada, Japan and US;

- Nationals of Andorra, Argentina, Aruba, Bolivia, Brazil, Brunei, Chile, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Ecuador, El Salvador, Estonia, Guatemala, Honduras, Hungary, Iceland, Israel, Korea (Rep. of), Latvia, Liechtenstein, Lithuania, Malaysia, Malta, Mexico, Monaco, Netherlands Antilles, New Zealand, Nicaragua, Norway, Panama, Paraguay, Poland, San Marino, Singapore, Slovak Republic, Slovenia, Switzerland, Uruguay, Vatican City and Venezuela;

- Transit passengers continuing their journey by the same or first connecting aircraft provided holding valid onward or return documentation and not leaving the airport (except nationals of Afghanistan, Bangladesh, Congo (Dem. Rep.), Ethiopia, Ghana, Iran, Iraq, Liberia, Nigeria, Pakistan, Somalia and Sri Lanka who always require a transit visa.

As the above list is liable to change at short notice, visitors are advised to check transit regulations with the relevant Embassy or Consulate before travelling.

Finding the Right Spanish Property

Selecting your property requires careful thought as the investment you choose today will have a direct effect on your future assets. Taking into account the right factors, such as location, quality and market trends, is of utmost importance.

Do keep an open mind when it comes to choosing the best property to suit your needs. Often what you think exists is not as readily available as you think and after much research and planning you may even end up deciding upon something completely different than you originally planned.

A Few Words of Advice

If you decide to buy in an up-and-coming area which is not yet built up, bear in mind that empty plots will be built on one day, so your property will sit among ongoing construction for many years to come and it may even lose its lovely view. Make sure also, that there is some “breathing space” on your land to avoid being overlooked from every angle.

- Look at local amenities, accessibility and security as they will all affect your future sale price or rental income. Is the area high in demand now or expected to be so in the future? If not then you may struggle to sell your property.

- Remember that a cheaper property inland will need to tick all the right boxes regarding easy access and local amenities if it is to prove a sound investment. Also, if you will need to make frequent flights, you will want to be near an airport.

- If you have health issues, you will need to consider buying in an area with a large municipal hospital and good doctors in the area.

- If you are relocating with children, you may need to be near International Schools.

- Find a qualified estate agent who is a member of the API (Agentes de la Propiedad Inmobiliaria) or GIPES (Gestores Inmobiliarios). Not all agents are qualified and recent legislation allows just anyone to open up a real estate agency. Good agents listen to you, are not pushy, share their market knowledge with you and if you stick with them, they will pull out all the stops to find you the right property for your needs.

- Find a reputable, English speaking lawyer to oversee your purchase and ensure you avoid any potential pitfalls. We will gladly assist you in finding a good lawyer.

- Purchase only for your own requirements, not the rest of the family, who are often unlikely to visit as often as you expect.

- Remember that reforms and modernizations take time, hassle and often more money than you envisage. If you decide to go down this route, be sure to obtain professional quotations prior to purchase and budget for unexpected surprises.

- Visit enough properties to enable you to make a correct market evaluation. Compare the actual sale price of properties for sale in the same area, not the asking prices.

- Be aware of orientation. No one wants to wake up on holiday to find the terrace and garden already in the shade, so almost never buy an east or north-facing apartment as the demand is very small!

Off-Plan Properties

- If you are buying a property off-plan, make sure the developer has an insurance policy or bank guarantee to protect your payments should the project not be completed. The developer must also be able to provide proof of ownership, planning permission and insurance over against building defects.

- If the price of your off-plan property does not compare favourably with that of similar finished or soon to be finished developments in the surrounding area then you are gaining nothing by buying off-plan.

- With an off-plan purchase, you should aim to pay as low a deposit as possible. Normally the lowest is 30/70, ie. 30% deposit and 70% payable on completion. You will need to walk away from any development asking more than 40/60.

- Be sure that you can sell on your contract before completion as not all developments allow you to do so and will not publicize this fact to purchasers. You will be better off with your options left open so it is advisable to avoid developments where selling on is not possible.

- Some developers say you can sell before completion but have a clause in the contract stating you may sell on only when they have sold all the other apartments within the development. You may not be allowed to sell for a lower price than the remaining apartments, or they may require you to sell through the developer’s sales office who will then charge huge fees for the privilege! Developers normally charge 1-2% to transfer paperwork from one name to another and this is normally paid by the purchaser.

- Ideally 16 months or more is advisable from initial contract to completion. You will need to allow 4 months to sell and 12 months to see an attractive amount of capital growth.

- Developments in Spain sell very quickly and normally over the course of construction the developers will increase prices four or five times. You need to get in as early as possible to maximize your profit.

- Remember that on a development that has a 30%/70% payment schedule, if the price of the apartment goes up 10% then that is actually a 31% gain on capital invested. See the example below:

Purchase price = €200,000

30% deposit = € 60,000

7% IVA (VAT) = € 4,200

Total capital invested = € 64,200

If the developer puts the price up by 10% then the increase is € 20,000.

If you bought the apartment immediately when is was released at € 200,000, then your gain would be as follows:

€ 20,000.00 / € 64,200.00 = 31%

If you had bought after the increase, then you would have lost a 31% gain!!!

The Property Buying Process

The buying process is relatively simple although the fiscal and cultural variations between countries make it advisable to get your own independent solicitor for ease and peace of mind.

Choosing a Lawyer

Because property law in Spain is subtly different to the UK & Ireland, you will need to enlist a Spanish lawyer to help with your purchase. He/She will ensure that you are making a sound and legal purchase. We have a portfolio of recommended lawyers. Firstly, your lawyer will commission a search. The searches will include the following:

• The boundaries and the legal description of the property

• The name of the person or companies listed as the owner of the property

• That there are no existing debts or mortgage charges against the property

• Building regulations have been observed and land has been properly designated for development

• Pending assessments for public works, e.g. storm drains

• Assessed valuation of the property so it agrees with the price paid

• Ensure that both water and electricity supplies are available

• Once the reservation fee is paid, there is nothing more to do until the private purchase contract (contrato privado).

Reservation Fee

Once you have chosen your ideal property you will need to pay a reservation fee, which is normally €3.000 - €6.000 (deductible from your 10% - 30% deposit). This is extremely important because it not only takes the property off the market, but it also freezes the price. The reservation fee is normally paid either by credit card or bank transfer directly to the developer.

Installments

If the property is under construction you may be required to pay installments which should reflect the stages of the building process. Bank or insurance guarantees should be offered by the Developer to cover these interim payments.

Be sure that the payment is refundable subject to legal checks as to ownership, planning permission, boundaries and legal description of the property.

Once the legal checks have been undertaken, the sale is performed before a Public Notary who acts as a legal representative of the State. The Notary checks the legal documents and witnesses the signatures.

Purchase Contract and Deposit

This contract will set out in detail the agreed purchase including price, payment term, completion dates etc. and you are generally required at this stage to pay a more substantial deposit of between 10% and 30% typically.

Once this document is signed and the deposit paid the buyer is committed to paying the balance of the property and the seller is committed to transferring the ownership of the land to the purchaser.

It is important that this contract is checked by your lawyer to make sure that all your rights and the vendor's obligations are incorporated into it. Often what is missing from a contract is more important than what is included.

Your lawyer will check that the vendor is the true owner of the property, carry out a Land Registry search, ensure that the property has no debts or encumbrances (such as an un-paid mortgage) and that the building is legally registered.

If you do not comply with all the terms of this contract you may stand to lose all monies paid.

You must receive guarantees either from a bank or an insurance company for any money paid to a developer for a property under construction.

Completion

The final payment is made at the time of taking possession of the property and this transaction is recorded in the Title Deed (Escritura de Compraventa) signed before a Notary Public.

At this time, any existing mortgage should be cancelled. If you are taking a mortgage with another bank the loan amount will generally be paid directly to the vendor on completion.

Many charges and debts incurred by the previous owner can be registered against the property if left un-paid and it is your lawyer's job to ensure that you buy the property free of any encumbrance and with the paperwork necessary to register the title in your name.

Many charges and debts incurred by the previous owner can be registered against the property. If these are left unpaid, it is your lawyer's job to ensure you buy the property free of any debts.

Once completion has taken place certain fees and taxes must be paid.

A property can be signed for once all documents and monies are ready. For new developments the escritura is only signed once the property is complete and the keys are ready to hand over should you wish not to sell prior to completion.

The Costs Involved in Purchasing a Spanish Property

As a rule of thumb, you should budget the combined total of between 10% and 12% of the purchase price to cover all the taxes and legal fees. In the Canary Islands, there are different rates of Tax (which are lower than mainland Spain), and you should ask your lawyer to give you a breakdown specifically for these islands.

The costs involved are:

Notary Fees (Gastos Notariales)

They vary depending on the value of the property and various other factors. Allow approximately 0.5% of the property price to cover these.

Land Registry Fees (Gastos de Inscripción)

These vary according to the locality, type and value of the property. They are not strictly taxes but fees charged by the Land Registry to inscribe your title.

Impuesto Sobre El Valor Añadido (I.V.A)

This is the Spanish equivalent of VAT. It is incurred when you buy from a Developer rather than the private individual. It is charged at the rate of 7% on the purchase price of all property with the exception of commercial property and plots which attract 16% IVA.

AJD (Stamp Duty)

A document tax or stamp duty which can be up to 1% of the purchase price is also levied on new property only.

Lawyers Fees

These will depend on which services you instruct your lawyer to undertake. Normally, conveyancing fees are based on a percentage of the purchase price. Always ask for a quote before instructing your lawyer, and be sure to know what is included in the cost.

Disbursements

In addition to the above costs, there will be other payments made on your behalf by your lawyer such as the Land Registry search fee, bank charges etc.

NIE Number

At the earliest possible time we recommend you apply for an NIE number (a foreigner’s identity number). This number is necessary when carrying out any financial transaction in Spain including buying a property.

The NIE numbers are issued at the National Police Station in the town where you are purchasing the property and you need to apply for these in person. Unfortunately, there are few hard and fast rules with regard to making the application as each town has its own rules. You will need your passport and a photocopy and complete the application form in duplicate using black ink. It is always useful to have several spare photocopies of your passport. You should go to your nearest National Police Station usually between the hours of 9am and 2pm and complete the NIE application form, but be prepared to queue.

Often, your estate agent will assist with this formality and they generally know the procedure in the area where they operate and will give you further guidance as to what additional, if any, documents you need to present.

Insurance

Once you are the owner of the property you should ensure there is adequate building insurance and contents insurance is in place. If a mortgage was used to buy the property, this is a mandatory requirement. Buildings are often insured by the community if the property is on a complex.

Banking in Spain

There are two main types of bank in Spain: clearing banks and savings banks.

Savings Accounts

In the latter category Spain has over 80 savings institutions called "cajas", which were originally charitable organizations granting loans for public interest and agricultural policies. Savings banks are similar to building societies in Britain and savings and loans in the USA and hold over a third of all deposits. Today these savings banks offer the same services as the clearing banks, often at more favourable rates.

Cheque Accounts

To open a Spanish checking account you will need to show your passport, your address in Spain and your NIE number from your residence card. Charges vary according to whether you open a resident or non-resident account. You should obtain a list of charges for services such as writing schedules and standing orders as Spanish banks levy some of the highest charges in Europe. Some banks, in particular the cajas have a monthly flat rate charge, which includes basic services such as direct debits. For as little as €2.00 per month for residents and €3.00 for non-residents, all your banking needs can be catered for (these figures apply to “La Caixa” in 2006).

Banking has become highly automated, and with regard electronic banking Spanish institutions compare favourably with other European countries and their ATMs are among the world's best. Credit and debit cards are widely used. Sometimes funds wired from overseas can take an extraordinarily long time to be available in your bank account in Spain, and even funds transferred within the same bank can float within the Spanish bank for many days before being accessible.

Bank opening hours in Spain are from 8.30 am or 9.00 am until between 13.30 and 14.30, Monday to Friday and from 8.30 and 9.30 until 12.00 or 13.00 on Saturdays in winter (banks are closed on Saturdays from June to September or October).

Some issues to consider when choosing which bank to choose in Spain:

- Ability to speak English (if you do not speak Spanish). Today most banks in tourist areas insist their staff speak more than one language.

- Facilities to send and receive money from overseas

- Whether they have a branch near your home or workplace

Spanish banks, including the cajas offer online banking, which is useful if you are going to be away from your property any length of time.

Bank Statements:

At most banks you can request that these are sent to you in English. Statements are sent to customers monthly or quarterly, but you can request one at any time.

Some questions to ask when opening your bank account in Spain:

- When you receive bank statements?

- When can you get an overdraft facility?

- How soon can you get your bankcard, credit card and cheque book?

If you receive regular payments from abroad, it is certainly worth shopping around for the best deal. EU state pensions paid into a Spanish Bank should not attract any charge.

List of some of the most popular Spanish banks:

- Santander Central Hispano

- Solbank

- Bankinter

- Banesto

- Grupo Banco Popular

- BBVA

- Banco Atlántico

- La Caixa

- Unicaja

Mortgages

Mortgage options in Spain include either a European mortgage or a re-mortgage through an existing property. Normally non-residents can borrow only 70% of the purchase price. However, it is possible to have a combination of 70% European mortgage and 30% re-mortgage. Interest rates in Spain are currently lower than in the UK but the costs for arranging the mortgage are high. If you are buying a new build property, a firm mortgage offer will only be given once the property is completed and a property valuation has been carried out.

Payment of Taxes

The relevant taxes (either IVA (VAT) if a new property or Transfer Tax if a re-sale property) must be paid within a fixed period of time to avoid fines. It is your lawyer’s job to ensure the appropriate completed forms are sent to the tax authorities on your behalf. Stamp Duty is payable after completion of the property at 1% of the purchase price.

Registration (Inscription)

Once the taxes have been paid, then Deeds (escrituras) can be delivered to the Land Registry for registration. This is probably the most important stage of the purchase and it is vital that the property is “inscribed” in your name from the start, to protect your interests.

Wills

Spanish inheritance law is very different and quite complex compared to UK law so it is important to have a Spanish will in place to ensure your wishes are respected. Technically a valid British will can be used in Spain but a Grant of Probate would have to be obtained which can be a lengthy and expensive business.

The level of inheritance tax paid by your heirs can be significantly affected by the way that a Spanish will is prepared. At the moment inheritance tax is higher if you are a non-resident. Wills have to be signed in front of the Notary and you have to be present for this. A Power of Attorney is not acceptable so ensure you arrange for your will to be signed either upon completion of your property or on one of your planned visits to Spain.

Other Costs

Local Rates

Annual local rates (IBI) are payable and are calculated from rateable value of the land. The rateable value takes into account the value of the land plus buildings as well as location, and usage and the tax is calculated at 0.85% of this value eg. a 2 bedroom beachside complex apartment in Marbella paid rates of €1.219/ £870 in 2003 and a free standing beachside villa in the heart of the "Golden Mile" paid annual rates of €2,500/£1,785 in 2003.

Rubbish Collection & Water Rates

The Town Hall sets this charge according to the property and this must be paid every 6 months. It will never cost more than about £200 per year. Water consumption is paid quarterly and is metered in cubic meters.

Community Fees

The purpose of the Community is to own and maintain the common areas within the community or urbanization. Depending on the size of plot, each homeowner must pay a contribution towards upkeep in the community areas and its services.

Community charges vary according to urbanization. A typical 2 bedroom apartment in a building with a hall porter, swimming pool, and a small garden, could cost between €120/£85 to €300/£215 per month or in a luxury development it could be as high as 600/£428.

An individual villa in an estate of villas could be liable for lower community fees as its private gardens and exteriors are not generally maintained by the community. Community fees cover the road and roadside garden maintenance, as well as services maintenance, and security.

Gardeners

Typical rates for private gardeners are about €14/£10 per hour. A full-time gardener’s salary could be around €1,000/£715 per month. Social security is an additional cost to full time wages and stands at around 40% of the salary.

Cleaning Services

Cleaners fetch full-time salaries ranging from €600/£428 to €800/£571 per month plus approximately €120/£85 per month social security contributions. Part time help usually costs anything from €8 to €10 / £5.7 to £7.15.

Electricity

Electricity is billed bi-monthly and is the most expensive service in Spain. Minimum rates are charged whether you are in residence or not, and the minimum varies according to the amount of electricity your house could potentially use with all power and lights turned on.

A minimum charge for an apartment might be around €25/£20 per month. Charges for a villa are from around €70/ 50 per month, depending largely on the extent of the electrical installation. Usage is €0.08/5.7pence per Kwh plus tax.

Fixed-line Telephone

The telephone bill is also charged bimonthly. Standard rates can be in the region of €20 per month including a touch dial telephone. There are telephone companies offering substantial savings and ADSL broadband is available virtually everywhere and fiber is now increasingly available.

Avoid Potential Pitfalls

When many buyers arrive in Spain with the intention of buying their dream Spanish property they can be easy prey to many of the pressure sales orientated Spanish Real Estate Agents, whose only goal is to sell property.

The good news is that buying Spanish Property need not be a story of horror but an easy and straight forward process and the investment opportunities are genuinely good. Like everything in life these days you have to be logical and streetwise and protect yourself using some simple and straight forward measures:

- Don’t let the sun affect your common sense

- Before travelling on a buying trip try to obtain an agreement in principle of the amount available to you from your lender and remember you need not only the purchase price but the purchase costs as well to be able to complete

- Remember the property you wish to buy is not the last property in Spain – if the paperwork does not stand up to scrutiny find another one

- Always seek independent legal advice before making any decision

- Don’t take legal advice from friends and acquaintances – with the best will in the world it is likely to be incomplete or inaccurate

- Make sure you know the full extent of the costs involved in purchasing by having your lawyer confirm the expenses to you.

- Don’t sign contracts in Spanish, even with an English translation. You may not understand the implications, and often the translations are poor or even missing details. It is often what is missing from a contract that is important, not what it contains

- Don’t commit yourself to a purchase if you need finance to complete without making sure you can have your deposit refunded if finance is refused

- Do not pay large amounts of money to developers who do not offer you the security of a Bank Guarantee for these payments. Generally, reputable developers will always offer guarantees – it’s the law

- Do not pay part of your purchase price in undeclared cash. This practice has been widespread in Spain but there are no benefits to you as a purchaser regardless of what vendors or their representatives may say.

- Make a Spanish Will for your Spanish assets. Not having a Will in Spain can delay your heirs from taking control of their inheritance.

- Do ensure you have sufficient insurance to cover your property, the contents, travel health and your car.

- Open a current account at a local bank early in your buying process.

- Make sure you know where your local doctor is located in case of emergencies

We are aware of many problems people have had when buying in Spain. Some have had homes built and not applied for and received the relevant permissions and consequently get fined heavily or even worse have their homes knocked down. This is exactly the same as you would expect in the UK should you build a home without planning permission.

We are professional and our agents are all experts in their specific fields, we ensure you are with the most relevant agent for your required property and keep in contact with all our clients to ensure they are happy with the service they are receiving and also to answer any questions or help with any problems you may have