Investment Property in Spain

Why Invest in Spanish Property?

With around 2.8 million legal foreign residents in Spain, not to speak of ever-increasing tourism figures, Spain has become a top destination for foreign property investment. Property is now the wise investors weapon of choice. No other investment allows you to purchase with other people's money (The Bank) and then pay this back with other people's money (the rental income from tenants). If you own property you can release equity against this, although there is no law that states that your property will increase in value year on year it is accepted that a well maintained property in a reasonable area will appreciate in value.

The Spanish Ministry of Tourism predicts that more than one million foreigners will set up home on the Spanish coast in the next six years, and this figure is expected to treble by 2025.

If you had bought in Spain a few years ago it is likely your property value would have appreciated around 20-30% per annum in some areas. Furthermore, if you had bought off-plan at a discounted rate and then sold at current market value, the increase would have been far higher. Thus it is obvious why Spain has become the location of choice for the knowledgeable property investor.

As with most markets, it is the ever-increasing demand for property in Spain that is driving the property price increases. Despite an apparent cooling of the market, there is no sign of demand diminishing and we can expect a respectable growth to continue into the future.

Indeed, it is widely published that 25% of British people aim to retire abroad and Spain is the most popular destination. Owing to a fantastic year-round climate, relatively cheap cost of living and close proximity to the UK, Spain continues to be high in demand. Budget airlines offer cheap flights from many UK and other northern European airports and generally you can travel to Spain in around 2 ½ hours.

The growth in the Spanish property market is driven by demand, but it is the property investor who benefits most while those that buy early – often off-plan at well below market value - will benefit from excellent returns on their investment property in Spain.

General Factors

Spain has many different market attractions. The Costa del Sol for example is considered expensive, but this area has the highest visitor levels throughout Spain and property prices are stable. Meanwhile, areas such as inland Andalucia and the Costa de la Luz could almost be considered as emerging markets themselves with much higher appreciation potential and lower prices.

Spain has benefited from massive EU subsidies over recent years, allowing for significant improvements in the infrastructure away from traditional resort areas.

Visitors are becoming ever more sophisticated in the way they book their travel and accommodation and rural and city breaks are becoming ever more popular. This is a good sign for property investors on mid-to-long term investment strategies, who will be looking to promote their properties for rental over the internet.

With increased competition among airlines and a fall in flight prices, more visitors are choosing Spain owing to its easy accessibility as a short break destination.

Clients have the opportunity to invest in anything from grand, all inclusive tourist complexes to smaller reform projects. However, buying off-plan property at reduced prices with unique terms of investment is always suggested as the best course of action.

Despite increased interest in all global destinations, Spain will continue to be a tried and tested market for clients seeking a safe investment.

Natural and Cultural Factors

- The dream lifestyle is a new priority for northern Europeans who have become disillusioned with the cold climate as well as unhealthy, unsafe and hectic lifestyles.

- Spain, particularly southern Spain, offers a fantastic, warm climate year round, allowing for an abundance of outdoor pursuits, such as over 26 golf courses, beaches and an attractive Spanish culture.

- Spain boasts some stunning beaches and breathtaking countryside which caters for all tastes. Rambling, golf, skiing, water sports and beach life are but a few of the ways in which residents and tourists enjoy the outdoors.

- An excellent infrastructure is already established,including European standards in medical and social security services.

- Spain is easily accessible from the UK, with links to countless regional airports. Budge fares abound and within 2 ½ hours you can be touching down in sunny Spain. Alternatively, if you need to dash back “home”, it will not be a lengthy logistical exercise to get there.

Economic Factors

- Lost confidence in the stock market. More and more people are disillusioned with their poorly performing pension and savings plans, PEPs and stock investments which continue to fall in value daily. Their number one priority has now become the search for opportunities that can give a satisfying return on their investment.

- Spain still offers value for money and excellent returns. The market remains buoyant and there is little sign of change for the foreseeable future. Despite a slight slowdown, construction continues relentlessly. Bought in the right location, property remains the favourite form of investment.

- Property prices in Spain remain a good deal lower than those back home, allowing people to afford a holiday or second home, or indeed relocate to the country and retire early. Spanish properties are becoming more popular as they provide an excellent investment as well as a holiday home.

- Off-plan purchases are a popular investment option for those in the know. You can avoid the full cost of paying for the property by paying in installments and selling the property on for a much higher price prior to project completion. Vast profits continue to be made with shrewd off-plan investment.

- A large flourishing rental market is offered in Spain and investment in a property with good rental potential can achieve excellent returns. Spain is a top choice for tourists who enjoy a variety of self-catering accommodation, apartments and private villas. Get it right, and you could rent your property out for six months of the year to cover costs and have it for your own use, free of charge, for the rest of the year.

- Young investors can afford to buy in Spain. There is a new trend emerging among the young under 30s British to get their first step onto the property ladder abroad as they can ill afford to do so in the UK. According to a recent survey by Atlas International, Spain is the number one their list.

- Rising prices seem set to continue for the foreseeable future, in both the popular coastal resorts as well as in easily accessible inland regions. Spain has a stable and mature property market, while prices have risen by 48% in the past three years. Experts predict that prices will continue to rise, albeit at a slower pace than in recent years.

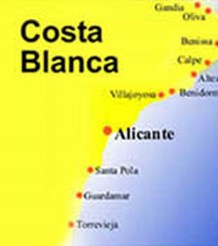

- The Costa del Sol and Costa Blanca are two prime investment areas, being the most popular tourist areas. Prices remain relatively high on both coasts but due to huge demand, you could be sitting on a goldmine in the long-term.

- Buying in Spain is a well-trodden path. There is plenty of expert, readily available advice on the subject and provided you use a good, independent lawyer, your purchase should be trouble-free.

Political Factors

Spain has a Constitutional Monarchy, with King Juan Carlos I as its Head of State since November 1975. King Juan Carlos was crowned after the death of the Dictator Franco, who had ruled since the end of the Spanish Civil War over half a century earlier. The Spanish Prime Minister, currently Pedro Sanchez, is nominated by the monarch after a successful election campaign.

As a result of the progress of the past 30 years, Spain is no longer considered to be the third world country it once was. Following massive economical and political upheaval, it is now one of the EU’s major powers and is considered to be one of the world’s most stable democracies.

Logistical Factors

Having benefited from massive European subsidies in the 1980’s and 90’s, Spain has established impressive road, rail, sea and air links with the rest of Europe and beyond. This is evident both in rural locations and in established tourist destinations.

Major airports such as Malaga, Alicante, Valencia, Barcelona, Gibraltar and Murcia handle the majority of Spanish tourist traffic, and most resorts are within one hour’s drive of an airport. Regional airports also have international services, such as Granada and Almeria, for example. The brand new Madrid International Airport is also a major hub for flights from all over Europe to Latin America. Iberia Airlines is one of the world’s largest carriers, and serves many global destinations with South and Central America as its specialty.

Short Term Investment Strategy

Key Opportunity

Spain is the largest market for Northern Europeans buying abroad, with an estimated 135,000 purchases taking place every year. Of this figure, 36% are British and 23% are German, with French, Italian and Irish buyers making up the remaining top places in the rankings.

Of Spain’s 22 million home owners, 3.8 million are foreigners with this figure predicted to keep increasing. By 2008, international financial analysts predict that over 200,000 properties will be purchased by overseas buyers in Spain each year. This represents an enormous potential market for those looking to flip their investments.

Off-plan prices are always far lower than completed prices, giving buy-to-flip investors good potential returns while the increase in value between off-plan release and completion of a project varies, subject to its location. Due to the high levels of construction, there will always be projects looking for substantial early investment to fund a project. This gives larger scale purchasers the opportunity to invest with certain guarantees on sales returns at an early stage. However, these opportunities are usually sourced on a bespoke basis by specialists upon request.

Supply in most destinations is staying ahead of this demand, with traditional tourist destinations such as Costa del Sol, Costa Blanca and Costa Brava maintaining construction levels. Growth areas of Spain with renewed building and resort programmes include the Costa Calida, Costa Almeria, Costa de la Luz and inland Andalucia. Outstanding resorts are under construction or going through the planning process across all the Spanish coastal areas, giving investors a wide choice of options.

Timescale

Average construction time on Spanish projects is 18 months from breaking ground. If investors are looking at the short term, the average term of the investment should be between 12-16 months from reservation to resale. As with all property investment, the earlier you proceed in the timescale of a project, the higher the eventual returns.

Payment terms on average tend to be 20% of the purchase price upon reservation and a further 10% is required after 6 months, leaving the remaining 70% to be paid upon completion of the project. Buy to flip investors would exit the investment prior to the due payment of 70%, entailing a minimum of capital investment and no need to obtain finance solutions.

Level of Complexity

Short term strategies in Spain are low in complexity due to the fact that there are no ongoing property costs applicable in terms of property management. The purchase consists of a simple capital investment; with no need to progress to a purchase contract or make any finance arrangements.

There may be charges made by the developer to assign a contract before completion, which should always be checked out before proceeding with a reservation.

The ‘flip’ can normally take place at any stage after the signing of the purchase contract and payment of full deposit in most cases. However, this should again be clarified at the time of committing to a project.

Key Risks

The past 2-3 years has seen the emergence of new ‘super resorts’ containing thousands of units on the Spanish coasts and it is important to be aware of the project size when purchasing off-plan on these sites. Possibly up to 50% or 60% of the total units purchased are made by investors with similar short term strategies.

Investors generally need to look to popular areas for their short term flip investment in order to give themselves the opportunity to gain a buyer when exiting the investment. These areas typically have increased competition from other investors and considerable construction so it is therefore important to ensure their unit stands out from the rest when they look to flip the investment.

Investors with standard units on a buy to flip strategy can easily become engaged in a ‘price war’ with fellow investors when looking to exit, and as a result are often simply content to walk away from the investment having broken even. Don’t let this happen to you!

On a purpose built tourist resort, investors must ensure adequate and multiple facilities are on-site. Unique residential complexes may not have on-site facilities and the development should therefore not be located in too remote a location and appeal to a bespoke market (such as skiers looking for property in Granada for example).

Spain continues to be a buyers’ market, with a wide choice and the ability to obtain property at excellent prices. However, if a buyer is not found prior to completion of the property, the investor needs to be confident that they will be able to continue to completion of the unit and adapt their strategy comfortably.

In summary, short term flip investments are far more risky in Spain today than in previous years when prime locations were still being developed. Construction has now been pushed away from front line beach and main tourist centers’, meaning the best option is to look for front line golf projects. However, with the level of construction ongoing, we would recommend caution when considering Spain for a short term flip investment strategy.

Return

Capital appreciation levels are at their highest early in an investment market. In Spain’s case, this was over 5 years ago, with the peak time for Spanish investors actually being well over 10 years previous to that.

However, short term gains are still a realistic possibility due to the continuous flow of buyers to Spain. Investors should however be aware that there are now more effective emerging markets elsewhere, ideally positioned to offer greater returns over a short term period.

Potential returns in Spain differ subject to the investment location. An emerging region as detailed previously could realize annual growth of 15%, but more established areas are more likely to realize an annual figure of anywhere between 5% and 10%.

For the most effective buy-to-flip investment in Spain, we suggests that investors reserve a unit on a project at its pre-release stage, where prices are at their lowest and subject to successful planning applications, followed by pricing uplift. Reservations on these projects should be fully refundable, and by choosing this strategy a greater time frame for capital appreciation is created due to a reservation made earlier than normal.

Please see the example below

- An investor purchases an off-plan 2 bedroom unit close to the beach on Costa Calida for €250,000 plus 10% tax/costs.

- The investor pays a €50,000 deposit of 20% upon signing the purchase contract

- Also at this point, the investor pays half the legal fees up front of €1,250, plus IVA on the deposit payment of 7% (€3,500).

- Total capital invested at this point is €54,750.

- The second stage payment is completed 6 months later for a further 10% of the purchase price at €25,000 plus 7% IVA of €1,750.

- Total capital invested after 6 months is €81,500.

- After year one of the investment, capital appreciation has realized at 10% for the year, meaning the property is now valued at €275,000.

- The investor decides to instigate an exit strategy after 16 months (just prior to completion), with capital appreciation continuing to perform at 10% per annum. The property is now valued at €284,167.00

- The investor finds a buyer for the property before proceeding to purchase contract, 14 months into the investment. At this point, to facilitate the sale, the investor settles remaining legal fees of €1,250.

- Total capital invested upon exit is €82,750.

- Sale price is €284,167.00

- The investor recoups capital invested, less the IVA and legal payments made of €7,750.

- Having recouped €75,000 of capital invested and seeing growth on the sale of the unit of €34,167, the total profit realized in using this short term strategy is €26,417, a return on capital invested of just under 32.5% over a 16 month investment timescale.*

*This is a simple example without taking any potential capital loan arrangements/costs into consideration, and also assuming that growth of 10% per annum remains constant. This figure is used for example purposes only.

Financing

As a short term flip, no finance arrangements shall be necessary as this is a simple capital investment. However, in order to cover all eventualities, short term flip investors must be confident that they can complete with finance if no buyer is found and a full purchase is necessary. If necessary, consultations can be arranged on equity release from existing property

Taxation

On a buy to flip strategy, the investor must pay 7% IVA on every stage payment completed. Capital Gains are currently 30% of declared gains, although this figure is set to fall to 17% in January 2007.

We recommend research into any double taxation treaties in place between Spain and the investor’s country of residence.

Medium to Long Term Investment Strategy

Key Opportunity

A buy-to-let strategy is highly recommended in Spain due to high levels of sustained visitor numbers. If investing for a rental return, any well established area is recommended although the choice of unit and project, preferably with full rental management and marketing, will ultimately determine how successful the investment is. Ideal locations for buy-to-let are the Costa del Sol, Costa Blanca, Costa Brava and in and around Granada for year round rentals covering the ski season at Sierra Nevada. Also to be considered are city rental strategies in locations such as Barcelona and Madrid, although these would be longer term, lower yielding rents.

With continuous high levels of construction taking place along the Spanish coast, a mid-to-long term strategy is always recommended rather than short term flip. This is due to increased competition from other investors and the relatively low capital appreciation potential over a short term investment period.

It is important to search for something unique, bearing in mind the highly competitive nature of the Spanish market. Always research the area thoroughly and define why your rental client or buyer will choose your property over others?

Look for hooks such as Guaranteed Rental and Leasebacks in particular, high bank valuations over purchase price for instant equity, low capital requirement, or just a unique location or situation. Simply purchasing a standard, middle of the range apartment on an off-plan project, with no outstanding highlights can be a risky choice.

In most locations, growth is steady if not dramatic. Spain is considered to be a safe investment location, while growth is lower in comparison with emerging countries, but the market is very well established and has strong appeal for the more cautious investor. The best areas of Spain in which to invest for growth potential as of the end of 2006 are the Costa de la Luz, inland Andalucia, Costa Calida and Costa Almeria. Estimates indicate that each of these areas should see growth in excess of 13% over the next year.

Timescale

Average construction time on Spanish projects is 18 months from breaking ground.

Five year strategies are suggested, to make the most of steady appreciation over a longer period, while funds are also generated via rentals to cover ongoing costs. As with all property investment, the earlier you proceed in the timescale of a project, the higher the eventual returns.

Payment terms on average tend to be 20% of the purchase price upon reservation and a further 10% is required after 6 months, leaving the remaining 70% to be paid upon completion of the project. This is a standard term, although better payment arrangements are available on good investment projects.

There are no price ‘crashes’ predicted for the Spanish market over the coming years. Prices do however, perform in cycles in established locations such as Costa del Sol, peaking, leveling and decreasing slightly over periods of around 2 years.

In comparison with emerging markets, a 4 year investment period in Spain making a 30% return on capital invested, would actually take around only 18 months to achieve in an emerging market, based on growth alone.

Level of Complexity

A purchase in Spain is relatively low in complexity as this is one of the more substantial markets in Europe and a well established process is in place.

Initial capital is generally spread between 1 and 3 payments over the construction period, with the balance payable upon completion, either with further capital or using one of many finance arrangements available.

Tax and costs are paid up to 10% of the property purchase price, including 7% IVA (VAT), 1% legal charges, notary fees, stamp duty and other miscellaneous charges. This top figure of 10% is rarely breached, although if finance is being arranged, these costs could increase to between 12% and 13% of the purchase price.

Sound, independent legal representation needs to be appointed to look after the purchase of a property in Spain. It is highly recommended that investors choose companies who are completely independent from the developer in question, to ensure a fair and objective service.

Many of the complexities of running and maintaining a Spanish property can be taken care of by a good management company, whether this is offered by the developer themselves upon completion or an independent company could be appointed by the investor. Ongoing maintenance costs, utility bills and taxation payments will need to be maintained and recorded. A Spanish bank account is necessary to facilitate these charges.

Key Risks

The past 2-3 years has seen the emergence of new ‘super resorts’ containing thousands of units on the Spanish coasts and it is important to be aware of the project size when purchasing off-plan on these sites. Possibly up to 50% or 60% of the total units purchased are made by investors with similar investment strategies.

Good marketing of the investment property is necessary on a buy-to-let strategy as this will maximise rental returns. Projects offering substantial management and rental packages are highly recommended and allow the property virtually to run itself.

There have been well documented cases of a phenomenon known as ‘land grabbing’ in Spain over recent years, where the local authorities have compulsorily redeemed land or property owned by foreign nationals for construction of infrastructure and/or facilities. This was mainly limited to one area of Spain only, due to local laws which have since been amended to protect the home owner. However, investors should clarify the potential for ‘land grabbing’ with their lawyer during the purchase process.

If a unique unit is purchased with investment hooks as detailed previously, within a growing area that offers excellent tourist rental potential, the element of risk is very low in comparison with early emerging property markets.

Return

Spain is considered to be one of the most established markets in Europe, and therefore the potential returns on off-plan property is lower in comparison with emerging markets. However, emerging markets are considered to be high risk in comparison, so the investor will need to decide upon a high risk, high return investment, or something safer but with a lower return on capital invested.

Over a 5 year period, provided a property has been sourced in a good location for steady growth, investors can expect a conservative annual growth rate of between 8% and 10% as an average. Areas such as the Costa Brava or Costa del Sol could be lower than this, although the likes of Andalucia are likely to be higher.

Please see the example below*

- An investor purchases an off-plan 2 bedroom unit close to the beach on Costa Calida for €250,000 plus 10% tax/costs.

- The investor pays a €50,000 deposit of 20% upon signing the purchase contract

- Also at this point, the investor pays half the legal fees up front of €1,250, plus IVA on the deposit payment of 7% (€3,500).

- Total capital invested at this point is €54,750.

- The second stage payment is completed 6 months later for a further 10% of the purchase price at €25,000 plus 7% IVA of €1,750.

- Total capital invested after 6 months is €81,500.

- After year one of the investment, capital appreciation has realized at 10% for the year, meaning the property is now valued at €275,000.

- After 18 months, the property has been completed and the investor has settled the outstanding balance of €175,000, plus remaining 7% IVA of €12,250.

- Other remaining costs are also settled at this point. Half of the legal fees were paid at the outset, leaving another €1,250 to pay plus up to 2% on other costs of €5,000.

- Total capital invested upon completion of the purchase is €275,000.

- The value of the property upon completing the purchase (18 months after initial reservation) is €288,750, having continued to benefit from 10% annual growth over the previous 6 months since the last valuation.

- Over the following 3½ years, the investor decides to rent the unit via a local management company, which generates funds to cover all ongoing costs.

- 5 years after making the initial investment, the decision is made to exit and recover capital invested and returns.

- Having benefited from 10% growth per annum over the first 2 years and 7% growth over the next 3 years, the property is valued at €370,575.00

- The investor sells the property at the valuation price. This represents profit on capital invested and costs met of €95,575.00, a return of just over 38%.

*This is a simple example without taking potential finance arrangements/costs and rental returns into consideration, and also assuming that running costs are covered by rental income which will not always be the case. Growth over this period will of course change each year. Conservative estimates have been used throughout this example.

Investment Finance in Spain

Mortgages

We will gladly point you in the right direction of Spanish financial institutions that will finance your investment. We have access to mortgages from over 30 Spanish and offshore banks, while the final choice depends solely on your circumstances.

Options Currently Available:

Low repayment - interest only

- Up to 15 years interest only

- Up to 70% final valuation

- No redemption fees

- Interest charged on daily basis

- Term up to 40 years

- Up to age 80

Low Deposit - 80% Valuation

- Up to 80% of final valuation

- Low initial interest rate

- Term up to 35 years

Bridging Loan for Purchase of New Property

- Up to 100% value of new property plus costs

- Payment holiday for first three months

- Interest only up to the end of the third year if unable to sell old property

- Before the end of 3rd year pay off debt on old property with no redemption fees

Low Repayment - Self-Certification

- Up to 50% of final valuation

- Up to 5 years interest only

- Minimum proof of ability to pay

Self-Certification - Self-Declaration

- Up to 40% of final valuation

- For individuals who are unable to prove their earnings – self declaration

- Up to age 75 – 80.

- Term up to 35 years

- Self-signed letter and copy of passport

Low Repayment - Equity Release – Re-Mortgaging

- Up to 60% valuation

- Interest only up to 15 years

- Term up to 40 years

- Up to age 80

- No redemption fees

- Equity release

- Up to 70% valuation

- Interest only for up to 2 years

- Term up to 30 years

- Up to age 75

Documentation Required

Spanish banks base their lending decision upon your net monthly income. Pay slips, tax returns and/or details on current accounts are all required as verification of income amounts. They will often also require the following documentation depending on your circumstances:

Employed:

- Last P60

- Last 3 month’s pay slips

- Last 6 months bank statements

- Employers reference confirming your role, length of service and current salary or copy of your employment contract

Self Employed:

- Last Self Assessment Tax Return

- Accountants Reference confirming gross and net income, plus drawings last year.

- Bank Statements

Company:

- Incorporation deeds

- Registration documents for Company (if SL Company)

- If in Spain, C.I.F. number

Retired:

- Confirmation letter from pension provider or pension slips.

- Bank statements for last three months

- Last Self Assessment Tax Return/P60

- All applicants must provide a copy of passports, NIE number and a bank reference.

Proof of Income

We can help you obtain a loan of up to 50% of the valuation of your Spanish investment, with a minimum amount of proof of income. Initially, lenders require a bank reference letter, a copy of your passport and a signed self-declaration.

100% Financing

It may be possible to raise 100% finance, depending on the valuation of your property. Such financing is normally more available for off-plan property investment as during the period between agreeing the purchase price and the completion date, the value of the property will normally have risen. Some banks will base funding on this final valuation and it may mean that 100% of the purchase price can be raised.

Raising Funds to Build Property

You can now raise funds for both the land and building work. As long as you have all the relevant building licenses, permission and architect’s plans, the lender will advance payment in stages as the building work progresses. During this time, you will pay only the interest due on the loan.

Re-Mortgage Facilities

You can re-mortgage provided you only have a small mortgage outstanding. However, remember that as you will be creating a new mortgage, costs for both cancellation of your existing mortgage and the setting up of the new mortgage will higher than you are accustomed to in the UK (normally around 4% of valuation).

Financing the Deposit for an Off-Plan Property

A mortgage in Spain can only be set up once the property has been completed and registered with the local land registry office. You cannot, therefore, raise the amount for the deposit, at the initial stage, through a loan on that property. Normally, investors raise this deposit either by cash they already have or by releasing equity on existing property they own in the UK. However, as the loan on completion can be based on the final valuation of the property, some of this cost may be recouped upon completion.

Mortgages in a Company Name

In theory, you can take out a mortgage on a property held by an S.L. Spanish company, an offshore company or a UK company. However, this process is more complicated than doing it in an individual name.

Time Scale of Application

Based on our experience of Spanish lenders and the mortgage application process, you will normally get a verbal indication within one to three days of whether your application is likely to be successful. This is subject to receiving the full application, required documentation and a valuation. Once all the paperwork is sent to the bank the full process should take approximately four to six weeks.

Provision of Funds

This is a detailed list of all the costs involved in your purchase and you should receive a detailed breakdown and explanation from your legal adviser before you go to the Notary. This list includes the following:

- Tax on the mortgage deed

- 5% of the Capital Gains liability of the vendor (in the case of non-residents)

- All fees (notary, registry and gestoria) for both the purchase and mortgage deeds

- Stamp Duty (for new properties only).

Equity Release

Put simply, equity release is a way of releasing some cash from the home without having to sell up and move house.

If you are in your mid-50s or older and own your own home, you may be able to get a cash lump sum, a regular income, or both, by using an equity release scheme based on the value of your property. These schemes can be helpful in certain circumstances to raise money for a mortgage to finance your Spanish property investment.

Alternative Finance

Not everybody falls into a category and some investors will need to raise finance in an alternative fashion to equity release or mortgage options. There are other borrowing facilities available to investors of Spanish property.

Taxation

Ongoing property ownership tax in Spain is known as IBI and the amount is subject to a combination of the location (Province) of the property and the purchase price. Different local authorities charge different percentages of the valuation price.

Capital Gains Tax in Spain is 30% of all declared gains, although this is set to be reduced in January 2007 to 17% on declared gains. Investors should check double taxation treaties between Spain and their country of origin.

The breakdown of additional costs associated with purchasing a Spanish property total up to 10% of the property purchase price, which includes 7% IVA (VAT), 1% legal charges as industry standard, notary fees, stamp duty and other miscellaneous charges.

Buy-to-let investors need to be aware of income tax in Spain that stands at 25% on declared income. However, with Leaseback schemes, there are excellent tax breaks available to investors and these are highly recommended.

Off Plan Property In Spain

Spanish off-plan investments can offer the investor the ability to achieve returns between 20-100% in just 24 months. Your generated profit can be free from capital gains tax if sold prior to completion. Our experts will advise you about this strategy. Keeping your property for a number of years will allow you to benefit from excellent rental income opportunities. Meanwhile you can enjoy a beautiful Spanish holiday home and watch property is appreciate in value.

Whether your off-plan purchase in Spain is for a villa, townhouse or apartment in Brazil, many developers will offer beneficial payment schemes. We carefully vet these offers and work with only the most reputable and secure development companies that operate in your favoured location. Payment schemes currently on offer allow you to buy property off-plan, i.e. before or during construction when the price remains low, with down payments of around 30% of the property price.

By the time the property is finished, prices rise due to market forces and the greater general appeal of a completely finished property that is ready to move into. Investors therefore sell the property on to another property purchaser and in doing so, enjoy some excellent returns of around 20%, whilst never having paid the full purchase price.

Investors should however exercise due diligence and choose wisely, making sure that their off-plan property in Spain is located in an area where they will resell quickly and easily or where there is a high rental demand for their buy-to-let option. With an off-plan investment, even in the “worst case” scenario if the property cannot be sold upon completion, the final balance due can often be financed by the developer himself, typically over 4 years or more. Furthermore, the rental income may pay off the finance of this loan and yield further eventual return on investment.

How can Property be Cheaper if Bought Off-Plan – How does it work?

In order to limit financial risk and debts, the developers of any project will wish to sell units off-plan. They understand that if buyers cannot see a physical property at the beginning, they will demand a lower price, while relying purely on the developer’s reputation, the property location, artistic impressions and computer simulations on which to base their decision to purchase.

In addition to the excellent off-plan price, some highly beneficial finance structures are in place. You sometimes need to pay around 30% of the purchase price in the form of a deposit, while the rest is payable upon completion. This may be financed by a mortgage if necessary.

If you decide to purchase off-plan investment property in Spain, you will need to decide which strategy you will adopt to achieve your return on investment.

Maximizing Profit From Off-Plan Investment in Spain

The Process of Price Increase

- Purchasing early

Prices never remain low for long and, as construction progresses, prices begin to rise steadily. In Spain, as in any other market, it is important to buy your villa, townhouse or apartment as soon as possible during the early stages of development when prices remain very competitive but are already beginning to rise. Early investors will invariably see the greatest returns. - Purchasing the best units

Early off-plan property purchase in Spain allows investors to choose the most sought after properties on any given development. The best units always offer higher capital appreciation in the smallest time frame and can often demand the greatest rental incomes. Penthouses are often firm favourites. - Price increases as development matures

As the development begins to be constructed, the value of the units begins to rise. A completed show home is normally available for viewing at this stage, while buyers are taking less of a risk as they now do not need to rely entirely on plans. - Price appreciates as more units sell

As more units are sold, the price of the remaining units rises. Units sell faster when buyers are able to physically see them. There is often a phase payment structure in place which mirrors the increasing value of the properties. To the early investor this means that, should you decide to sell your property, it will be worth considerably more at this stage than when you made your initial purchase and paid the 30% deposit.

"Buy To Let" Strategy In Spain

Spain has a huge "Buy to Let" market due to massive demand for Spanish accommodation mostly during the Summer months. It is this demand that has driven the Spanish investment property market forward. With so many low cost airlines servicing such a wide range of UK and other European airports into many locations in Spain on a daily basis it is little wonder that investors look to Spain for solid rental yields on investment property purchases.

The Internet revolution has also greatly improved the occupancy rates for Spanish property investors as now growing numbers of visitors to Spain avoid the traditional travel agents and book flights and accommodation online.

Spain's coasts have several major demand drivers that help generate good all year round tourism and in proportion rental occupancy rates:

Weather and beaches - High Season

During the summer obviously the beaches are popular and millions flock to the Spanish Costas from within Europe to the guaranteed sunshine. Obviously this generates huge demand for rental accommodation in major Coastal areas.

Golf - Low Season

In the low season Spain manages to maintain a high level of tourism and property investors occupancy rates with the demand generated from its many golf courses. This is a major reason why investors look to the Spanish coast as investors near major golf courses can expect good rental profits in the low season also, extending the rental year, and allowing owners to operate longer on more profitable short term rental rates rather than look for lower yield long term tenants.

Skiing - Winter (Mountains)

The Sierra Nevada Mountains near to Granada, offer investors yet another serious rental income stream. The Ski resort here is growing in popularity and generates visitors from great distances for Skiing breaks.

Low Cost of Travel

As mentioned above the large number of airlines operating from so many European destinations into many Spanish airports is also a huge advantage to property investors looking for rental return as it makes their investment accessible. Also with so many airlines in competition if forces the price of flights down making visiting Spain very competitively priced.

Buy to Let Case Study

John has savings of around €80,000.

John selects property development X which has been vetted as a solid investment opportunity and meets with John's deliverable criteria.

Investment property X is a new development with beautiful sea views on the Costa del Sol and priced at €250,000.

Initially John pays his reservation fee of €3000 to hold the property.

Next John pays a 30% deposit of €75,000 (minus his €3000 reservation fee already paid)

John negotiates a mortgage for the remaining €175,000 at a rate of 2.75% (example only) this translates to a monthly mortgage repayment of €481.00 (interest only) which is equal to €5772.00 over 12 months.

John starts to rent his new property immediately and during the 3 months "High Season" he receives €2000 per month in rental income. These rental payments exceed his annual mortgage repayments and still leaves John with 9 months of rental potential to make a further profit.

If we assume that average rental rates for Johns new property are as follows (conservative figures):

- High Season - €2000 Per Month

- Low Season - €1300 per Month

Now we assume that John decides to go on a short term rental strategy maximizing his income over the High Period. He easily rents his property for 3 Months during the high period earning €2000 per month. After this period he has a delay in getting his next tenants but over the course of the year he rents his property for a further 6 Months only.

- 3 Months x €2000

- 6 Months x €1300

Total Rental income = €13,800 after subtracting the €5,772 Mortgage repayments John has made a profit of €8,028.

* During this example we have not included any rental management or community fees that may apply but also we have only assumed rental income for 9 months of the year and with many holiday makers now booking private accommodation via the Internet this is very achievable.

The "Buy-to-Let" model is becoming more and more popular with the increase in demand of rental property as many holidaymakers are now utilizing the Internet to benefit from cheap flights and cheaper accommodation by booking direct.

Short-Term Letting vs Long-Term Letting

The final decision to be made by the "Buy to Let" Investor is which letting strategy to use. Its obvious that the highest income is made by the property owner by letting out short term during the high season. However you can off-set this against the increased overheads in constantly finding short term rental clients and the maintenance costs between clients. Long term rentals typically pay less on a month on month basis but usually require far less input from the property owner and the rental income is fixed over the course of the year. Some property owners choose to rent long term during the low season and then short term to higher paying holiday clients during the high season. The decisions to be made on your letting strategy are usually answered in part by the property you purchase. Some properties lend themselves to short term holiday makers and others to long term locals as a permanent home. Our experts will help you decide what's best and choose the property and rental strategy that's best for you.

The "Buy to Let" Strategy is not ideal for EVERY investor and it is essential that property for this strategy is chosen wisely as it needs to be a rentable property in a popular location to allow the investor to maximize income from the Investment.

The other benefit from this type of investment property in Spain is that during the time this property is being rented and earning the Investor an income and holiday home it is still appreciating in value at one of the fastest rates available. All in all the "Buy to Let" Investment model is a sound investment decision and Spain is currently an ideal location to deploy this strategy.

Summary

Now is the ideal time to make an intelligent investment in Spanish property. Low interest rates, a strong economy and a huge demand for rental accommodation is further fueled by the revolution of internet bookings.

Spanish property investment has been popular with investors for a long time and is still the favourite location for UK investors due to many factors, including the number of low cost airlines operating from over the UK to many destinations within Spain. Many investors look to secure a rental income from their investment property and Spain is one of the safest options for rental yields, due to its established tourist industry which over the years has proved it can reliably satisfy this requirement.

In the past four years alone, the British have increased their spending on overseas properties by 45%, the favourite destinations being in Spain, then France.